The Inflation Reduction Act (IRA) is frequently cited for the proposition that renewable energy resources will become more competitive with traditional generating plant technologies. However, it may come as a surprise that researchers are now claiming that renewables are more economical than all (but 1) of the remaining coal plants.

This is the conclusion of the just released Coal Cost Crossover 3.0 report (a copy of the original report by Energy Innovation Policy & Technology LLC is attached). Observing that “New coal retirement announcements seem to happen faster, even as natural gas prices skyrocket, and renewable energy prices keep dropping,” the Report finds that:

- 99 percent of all coal-fired power plants in the U.S. are more expensive to operate on a forward-looking basis than the all-in cost of replacement renewable energy projects, and 97 percent are more expensive than renewable energy projects sited within 45 kilometers (approximately 30 miles), a significant acceleration from our two previous analyses.

- All but one of the country’s 210 coal plants are more expensive to operate than either new wind or new solar.

The report specifically credits the IRA for the dropping renewable energy prices.

The IRA will extend generous tax credits to all forms of clean energy for the foreseeable future (until electricity sector greenhouse gas emissions fall 75% below 2022 levels). However, what is often overlooked is that the costs to deploy renewable resources are no longer declining. In fact, they are increasing due to rising costs for raw materials (including metals and rare earth minerals), labor, and transportation. It is unclear whether these increases were recognized in the national data bases used in this research. The more generous tax credits have already enabled wind turbine and solar panel suppliers to implement needed increases in equipment prices.

Importantly, the report does not disclose critical information about the magnitude of the capital requirements (both generation and transmission) to replace and retire all but one operating coal unit. According to S&P, there are approximately 210,000 megawatts (MW) of coal units currently in operation. Replacing 210,000 MW with an equivalent amount of accredited capacity supplied from renewable resources could require $1.5 trillion of capital just for the generating equipment.

Our review of the report reveals that the underlying analytics are overly simplistic and lack rigor.

For example, the analysis uses a levelized cost of energy (LCOE) to compare the cost of new renewable resources with the going-forward cost of coal plant operation. LCOE is not a legitimate metric for measuring the all-in costs and rate impacts of renewable resources. LCOE simply measures the average per unit capital and operating costs of a resource the over its expected lifespan based on the estimated megawatt-hour (MWh) produced from the resource. Thus, it completely ignores integration costs, capacity value, the interactions between new and existing system resources, and transmission system upgrades to support full operation while maintaining grid reliability. (Although renewable resources that can be located at or near existing coal plant sites with minimal integration/upgrade costs, they could not fully replace the capacity/energy provided by the retired coal units.) At best, LCOE reveals the cost when the resource is actually operating (i.e., you are in great shape for the shape you are in).

Also, the marginal cost to continue operating existing coal plants consisted of the cost of fuel, variable operating and maintenance expense, and going-forward routine capital costs each calculated on a per-MWh basis. The authors used trend analysis to project these costs using 2021 as a base year. It is unclear that 2021 is a reasonable starting point or that the observed trend would apply to each individual coal unit. Further, the report did not disclose the assumed capacity factors of the coal units. If the assumed capacity factors are understated, the going-forward operating costs per MWh will be overstated.

Further, the Report did not provide any sensitivity analysis. So, it is impossible to determine if the same conclusions would be reached under different scenarios (e.g., lower coal and/or higher gas prices; higher capital costs; higher or lower capacity factors).

Even if it were more economic to do so, it is unclear that retiring all but one coal unit is feasible particularly in areas experiencing (or projecting) near-term supply shortages or load growth due to increasing electrification.

Finally, although we acknowledge that the primary disadvantage of coal units is that they are major sources of greenhouse gas emissions, we must also recognize that coal units can also provide significant benefits. The direct benefits include:

- Dispatchability.

- A significant amount of nameplate capacity is accredited (i.e., capable of meeting peak demand).

- Fuel diversity.

- Supply security.

- A physical hedge against skyrocketing natural gas prices/supply shortages.

These benefits were largely ignored, although the authors do acknowledge that reliability is a necessary system attribute that “…replacement renewable portfolios need not bear sole responsibility.” Importantly, the report does not address or make any claim that electricity rates would be lower and that reliability would not be adversely affected by replacing all existing coal units with renewable energy resources on a “one-to-one basis.”

In summary, Coal Cost Crossover 3.0 is not serious research, and its findings should be taken with a grain of salt. Unfortunately, as the headline below demonstrates, the benefits and necessity of maintaining an electricity supply that is both reliable and affordable will be overlooked.

All US coal plants except 1 are less economical than wind, solar – researchers EXCLUSIVE

Monday, January 30, 2023 9:52 AM CT

By Taylor Kuykendall

Market Intelligence

| The Dry Fork Station in Wyoming was the only coal-fired power plant that is cheaper to run than new wind or solar, according to new analysis from Energy Innovation. Source: S&P Global Market Intelligence |

Policymakers have dramatically strengthened the economic case for retiring U.S. coal-fired power plants with the Inflation Reduction Act, according to research released Jan. 30 by Energy Innovation Policy and Technology LLC, a nonpartisan energy research group.

The Inflation Reduction Act, signed into law in August 2022, extended and expanded multiple tax credits for low-carbon energy projects and introduced new funding to back loans for refinancing fossil fuel assets and reinvesting in energy infrastructure. The bill also offers a 10% tax credit for renewable projects in communities particularly affected by the transition away from fossil fuels.

Energy Innovation reviewed 220 GW of coal capacity remaining in 2021 and concluded that 99% of the plants are more expensive to operate on a going-forward basis than the all-in cost of replacement renewable energy projects. About 97% of the coal plants analyzed were more expensive than a new renewable project sited within 30 miles.

“Almost every utility plan that was created before last August needs to be ripped up and looked at again because of the seismic shift in economics,” Eric Gimon, a senior fellow with Energy Innovation, said in an interview. “That’s one of our first recommendations: Look at the plans again because this is a big difference from the situation just a few months ago.”

In December 2022, an S&P Global Market Intelligence Power Forecast projected that 117 GW of fossil generation would retire as pressure from the Inflation Reduction Act mounts over the next two decades. The Energy Innovation study suggests that they should retire a lot sooner.

“We’re really excited about this result because now it looks like, by siting renewables really close to coal plants, you could use their grid interconnection, potentially, and avoid a lot of that grid interconnection delay and costs,” said Michelle Solomon, a policy analyst with Energy Innovation’s electricity program.

Just one of the 210 coal plants studied proved less expensive than renewable alternatives available locally or regionally: Basin Electric Power Cooperative‘s Dry Fork Station in Wyoming, which Solomon said was slightly cheaper than regional wind resources. Researchers said it is also one of the newest coal plants in the U.S. and therefore has lower maintenance costs.

Incorporating the Inflation Reduction Act’s new energy community tax credit renders 199 of the 210 coal plants less cost-effective than solar energy options that could be sited within 30 miles of the existing coal power generators. Comparatively, wind could cost-effectively replace the power of 104 coal plants within 30 miles of existing plants.

The researchers estimated that replacing the existing coal with local wind or solar power could produce $589 billion in local capital investment.

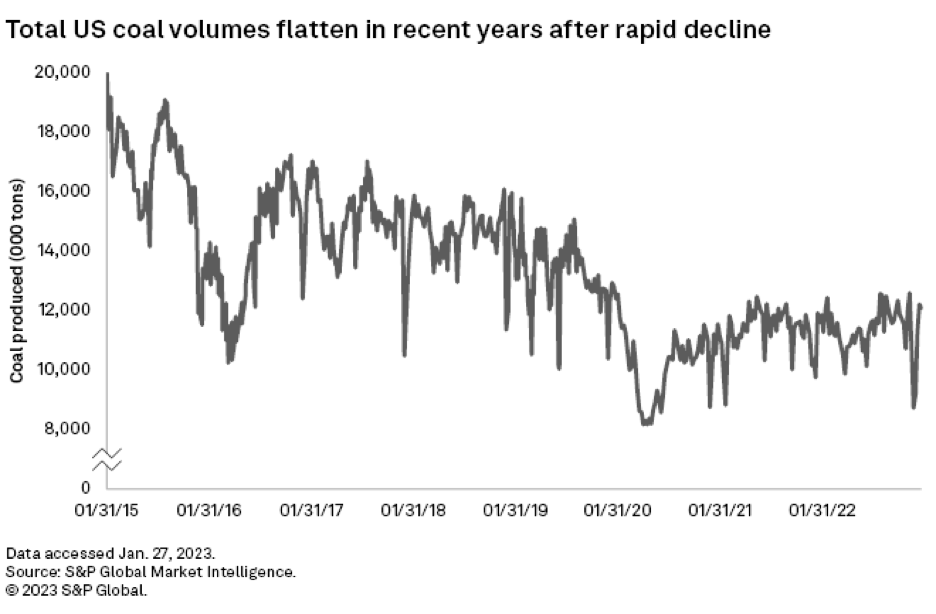

Coal production has declined dramatically over the last decade, but it has been relatively stable in recent years, in part due to increased exports and higher demand as the economy recovered from the initial blows of the COVID-19 pandemic. Coal’s share of electricity generation in the U.S. is expected to fall to 18% in 2023 and to 17% in 2024, from 20% in 2022, according to the latest short-term energy outlook from the U.S. Energy Information Administration.

Despite a strong economic case, researchers acknowledged cultural and economic roadblocks to weaning the grid from coal power. Local communities have blocked both wind and solar plants, and former President Donald Trump, who remains influential with his constituents, rarely misses a chance to criticize wind turbines.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.