With the recent harsh winter storm disruptions in its rear-view mirror, NERC issued its first ever top-level call to action on winter reliability (see article 1 below). This level 3 action (the highest alert level) calls on generation and transmission owners to report their winter weatherization plans by October 6. With the continued retirement of dispatchable generation, it is no wonder that NERC is rightly concerned that any significant outages could jeopardize reliability.

Also this week, the EPA issued proposed rules that would require the use of carbon capture and hydrogen for new and existing power plants (see article 2 below). Neither technology has yet to be successfully deployed at scale, and neither can be characterized as the best available technology. If adopted, the proposed rule would make it all but impossible for fossil fuel plants, which are currently the best source of dispatchable generation, to compete with subsidized renewable generation.

This latest action once again demonstrates how government agencies (with three letter acronyms) are pursuing their climate agendas without regard for the impact of their rules on the reliability and affordability of electricity as demand increases. As I have stated in prior blogs, such unilateral policy actions exemplify poor governance.

NERC to issue its 1st top-level call to action on winter reliability EXTRA

Friday, May 12, 2023 1:48 PM CT

By Molly Christian

Market Intelligence

Massive and disruptive winter storms in recent years are prompting North America’s electric grid watchdog to take an unprecedented step to guard the bulk power system.

On May 15, the North American Electric Reliability Corp. will issue a Level 3 action alert — its highest alert level — calling on generation and transmission owners to report their extreme weather mitigation plans for next winter. The move marks NERC’s first issuance of a Level 3 alert.

The pending action follows several harsh cold-weather events in recent years, including a winter storm that slammed Texas in February 2021 and another cold blast in late 2022. The extreme weather and ensuing grid disruptions prompted the Federal Energy Regulatory Commission to expedite the approval of cold weather reliability standards in February.

NERC’s alert, which its board approved May 11, requires several “essential actions,” according to a recent presentation from NERC staff.

Before next winter, generation owners must calculate the extreme cold weather temperature for each plant location and identify freeze protection measures for critical components. Plant owners will also need to determine which units can operate at extremely cold temperatures and those requiring additional freeze protections and identify any of their plants that experienced a cold weather reliability event in winter 2022-2023.

Generation owners must share their responses with relevant balancing authorities and transmission owners and alert them if freeze protection measures will not be implemented before next winter.

The alert will also make transmission owners update their operating plans to minimize overlap of circuits for manual load shed and those used for under-frequency load shed or under-voltage load shed, the presentation said.

Balancing authorities will also be asked to update their operating plans to include provisions for transmission owners to carry out controlled manual load shed.

Reports from affected entities are due Oct. 6.

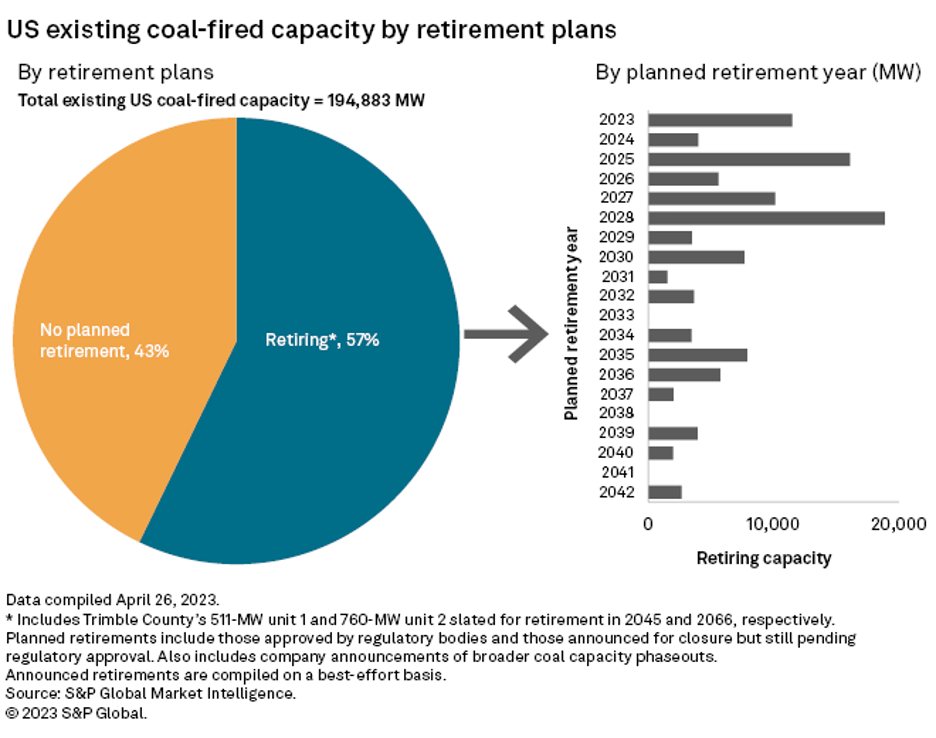

Severe winter weather has become a growing grid reliability challenge in parts of the US. In its last winter reliability assessment in late 2022, NERC warned of potential challenges from higher peak-demand projections, poor weatherization, fuel supply problems and limited natural gas infrastructure. Some industry groups have also flagged the loss of coal-fired generation as a threat, with a substantial amount of coal capacity retiring due to market and regulatory pressures.

Level 3 alerts from NERC include actions deemed “essential” to bulk power system reliability and require alert recipients to file their responses with the grid watchdog. By contrast, Level 1 advisories are purely informational and warn registered entities of potential issues, with no responses required. Level 2 alerts provide specific recommendations to address possible reliability problems, with responses to NERC required.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

US EPA proposes carbon capture, hydrogen rules for new and existing power plants EXTRA

Thursday, May 11, 2023 4:01 AM CT

By Zack Hale

Market Intelligence

| Emissions rise out of three large smoke stacks at Pacificorp’s 1,440-MW Hunter coal-fired power plant in Castle Dale, Utah. Source: George Frey/Getty Editorial via Getty Images |

The Biden administration is moving to set strict emission limits on new and existing fossil fuel-fired power plants that would eventually require most of those units to adopt emerging technologies such as carbon capture or green hydrogen.

Under the proposed standards, unveiled May 11 by the US Environmental Protection Agency, nearly all coal-fired power plants without carbon capture and sequestration (CCS) technology would be expected to cease operating by 2035. Larger natural gas-fired power plants that operate at a high capacity factor would also be required to co-fire with 30% clean hydrogen by 2032, ramping up to 96% by 2038. Compliance flexibilities would be given to generators that only run during periods of peak demand.

Once finalized, the standards are expected to face legal challenges that could ultimately be decided by a Supreme Court that has become increasingly skeptical of administrative rulemaking.

If successfully defended, the rules would stop just short of requiring US electric utilities to accelerate their decarbonization plans in line with President Joe Biden’s goal of achieving a 100% carbon-free US power grid by 2035. Some units would still be allowed to emit relatively small amounts of CO2 past that date.

But senior administration officials maintained that the proposed standards are part of a broader package of power-sector regulations that will help the US cut economywide greenhouse gas emissions by at least 50% by 2030 as part of its commitment under the Paris Agreement on climate change.

“When you look at what is in this rule and what has been proposed, we are absolutely in line with the president’s goal,” EPA Administrator Michael Regan told reporters May 10.

The regulatory action represents an aggressive effort by the Biden administration to lock in the first-ever greenhouse gas emission limits on existing fossil fuel-fired power plants following a major legal defeat at the US Supreme Court in West Virginia v. EPA.

The high court’s conservative majority ruled in June 2022 that the Obama-era Clean Power Plan — a 2015 regulation that never took effect — amounted to an overreach of EPA authority by encouraging a nationwide shift away from coal-fired electricity.

The decision marked the first time the court’s conservative majority invoked what is known as “the major questions doctrine,” a relatively new line of legal reasoning that holds agencies must point to clear congressional authorization when regulating on matters of “vast economic or political significance.”

Despite the court’s West Virginia ruling, the EPA is still legally obligated to regulate existing fossil fuel-fired generators under the Clean Air Act. The mandate flows from a 2007 US Supreme Court ruling in Massachusetts v. EPA, in which the court found that the act gives the EPA statutory authority to regulate greenhouse gas emissions that may contribute to global warming, and a subsequent EPA finding upheld by the courts that greenhouse gases endanger public health and welfare.

Proposal would account for fuel type, planned retirements

But in West Virginia, the Supreme Court found that Section 111(d) of the Clean Air Act, which covers existing generators, does not allow the EPA to set emission limits that would effectively require broad generation shifting to cleaner power sources like wind and solar.

Unlike the Clean Power Plan’s approach, the EPA’s May 11 proposal largely relies on “inside the fence line” measures that can be implemented directly at generating facilities, such as CCS or co-firing with clean hydrogen.

The new proposal would create an array of subcategories for new and existing generators, with compliance options that vary based on fuel type and how long a unit is expected to operate. One set of emissions standards would cover existing fossil fuel-fired steam generating units, which are predominantly coal-fired power plants.

Existing coal-fired units with plans to operate beyond 2040 would be required to install CCS equipment capable of capturing 90% of a facility’s carbon emissions starting in 2030. However, coal plants that commit to retiring by 2035 and operating with an annual capacity factor of less than 20% could otherwise run routinely.

The proposed standards would result in a 99% reduction in coal-fired capacity without CCS by 2035, according to the EPA’s regulatory impact analysis. The agency also estimated coal-fired capacity with CCS would grow from a baseline of 8 GW in 2040 to 9 GW in response to the requirements.

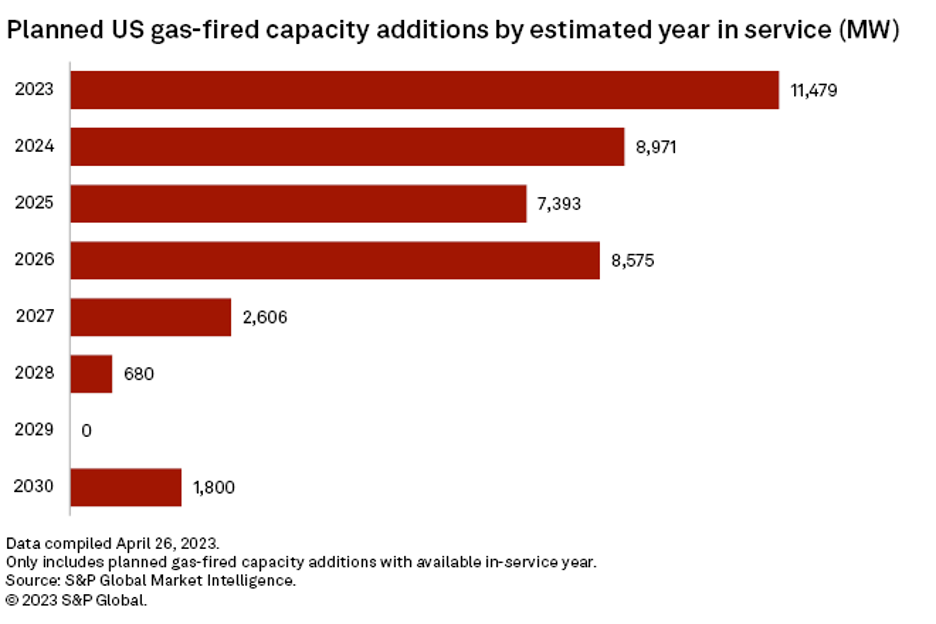

A second set of standards would target CO2 emissions from new gas-fired generators. Combined-cycle units that commence construction after 2023 and operate with an annual capacity factor of more than 50%, considered “baseload units,” would be required to co-fire with 30% clean hydrogen or implement CCS by 2030 or 2035 under a less stringent proposed option. The clean hydrogen requirement would increase to 96% by 2038.

About 13 GW of natural gas-fired capacity would be expected to co-fire with clean hydrogen by 2040, while 8 GW would opt for CCS, the EPA estimated. So-called “peaker plants” that commence construction after 2023 and operate with an annual capacity factor of less than 20% would not be required to implement additional greenhouse gas controls.

A third set of standards would target existing gas-fired power plants with the highest CO2 emissions. Those plants, defined as greater than 300 MW in nameplate capacity with annual capacity factors of more than 50%, would be subject to emissions guidelines similar to the proposed requirements for new baseload gas plants. Existing gas-fired units meeting that definition would need to install CCS by 2035 or co-fire with 30% clean hydrogen by 2032 and increase that level to 96% by 2038.

Overall, the proposed standards are expected to avoid more than 600 million metric tons of CO2 emissions by 2042 — the equivalent of a year’s worth of emissions from roughly half the cars in the US, the EPA said.

‘A powerful driver of progress’

On the May 10 press call, White House Climate Adviser Ali Zaidi stressed that the EPA’s proposal accounts for generous federal tax credits for carbon capture and clean hydrogen production included in the Inflation Reduction Act.

“Learning rate improvements are and will continue to be a powerful driver of progress on US energy security and the shift to a clean energy economy,” Zaidi said.

The Inflation Reduction Act provides up to $85 per ton of CO2 captured and stored by industrial facilities such as power plants, as well as $60 per ton of CO2 utilized in other processes. It also included tax credits of up to $3 per kilogram for hydrogen with a CO2-emitted equivalent of between 0 kilograms and 0.45 kilograms.

Implementing CCS at existing US coal plants has proven unsuccessful in the past. Only one of eight coal-fired power projects previously selected by the US Department of Energy for CCS funding, the Petra Nova plant outside Houston, was completed. The CCS facility ceased to operate altogether in May 2020 after low oil prices rendered the unit uneconomic.

But EPA officials May 10 stressed that the agency’s proposal includes compliance deadlines with ample lead time as the DOE readies an additional $2.6 billion in funding for CCS demonstration projects, including two at new or existing coal-fired power plants.

NET Power LLC, a startup specializing in new gas-fired power plants that capture nearly all of their CO2 emissions, is also aiming to produce dozens of units by the end of this decade. “The economics work without a government mandate,” Danny Rice, the company’s incoming CEO, said in a recent interview.

One early hydrogen adopter is the Los Angeles Department of Water and Power (LADWP), which plans to retrofit several plants for green hydrogen starting with the LADWP-operated Intermountain power plant in Delta, Utah. The coal-fired plant will be recommissioned in 2025 with new Mitsubishi Power Americas Inc. gas turbines to run on an initial blend of 70% gas and 30% hydrogen. From there, the utility plans to increase the percentage of hydrogen in stages but has not committed to reaching 100% until 2045.

Comments on the EPA’s proposal are due 60 days after its publication in the Federal Register.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Siri Hedreen and Anna Duquiatan contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.