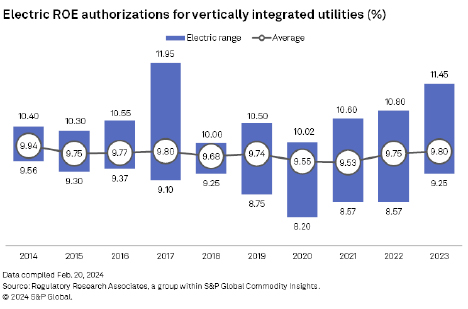

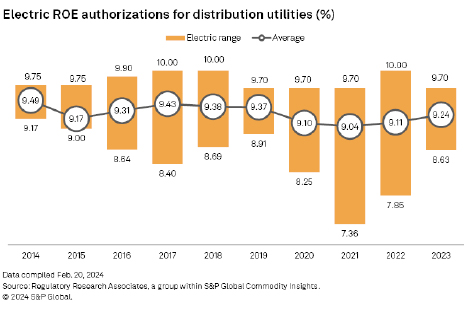

Rising interest rates are slowly being reflected in the return on equity (ROE) authorizations in electric rate cases decided in 2023. Vertically integrated (generation/transmission/distribution) utilities were authorized ROEs of 9.8% (vs. 9.75% in 2022) – see the blue bar chart below. Wires-only (distribution) utility authorized ROEs were 9.24% (vs. 9.11% in 2022) – see the orange bar chart below.

A few other notable points:

- But for an unusually high (11.45%) ROE authorized for an Alaska utility and the 10.65% to 10.75% ROEs authorized in California, the average ROE authorized in 2023 for vertically integrated electric utilities would have been 9.66%.

- One of the lowest authorized ROEs (9.2%) was awarded to Northern States Power Company (Minnesota). This award was based on testimony sponsored by J. Pollock associate, Billie LaConte, citing the many rate enhancements (including a multi-year rate plan) that significantly reduce regulatory lag.

- The highest authorized ROE for a distribution-only utility was 9.70%, which was awarded to Oncor (in Texas). This award was notable because it was significantly higher than the ROE recommended by the Administrative Law Judge (ALJ) and was one of the first decisions made by the recently expanded Public Utility Commission of Texas. Had the ALJ’s recommendation been adopted, Oncor would have had to reduce (rather than increase) distribution rates.

- Distribution-only utilities in Illinois continue to receive very low (sub 9%) authorized ROEs. In the aftermath of its recent negative rate order rejecting its proposed multi-year rate plan, Exelon subsidiary, Commonwealth Edison, announced lower projected five-year CAPEX.

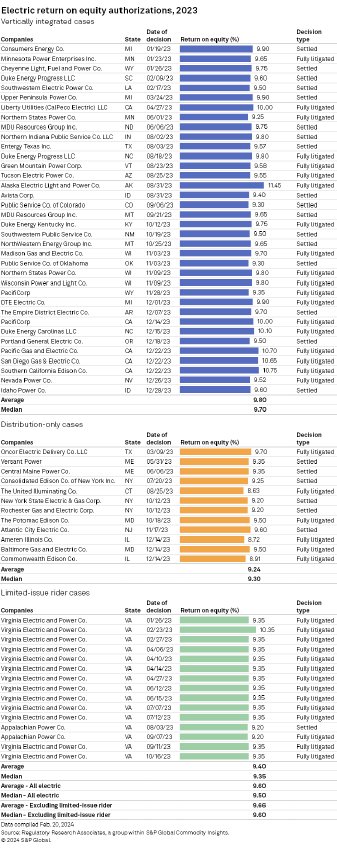

The authorized ROEs in rate case and limited case proceedings are listed below.

RRA REGULATORY FOCUS

Uptick in 2023 electric authorized returns: Visualizing and ranking the data RRA

Friday, February 23, 2024 9:24 AM CT

By Lisa Fontanella

Market Intelligence

The average authorized returns on equity for electric utilities in the US trended modestly higher in 2023.

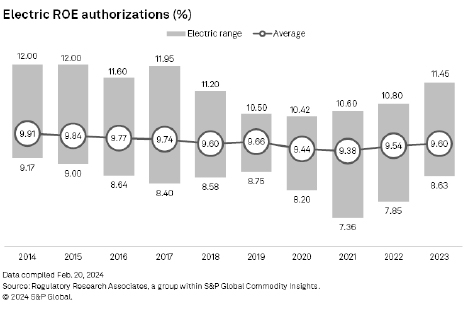

Data gathered by Regulatory Research Associates showed the average ROE authorized electric utilities was 9.60% in rate cases decided in 2023, slightly above the 9.54% average for 2022. There were 63 electric ROE authorizations in 2023 versus 53 in full year 2022.

The Take

➤The average authorized return on equity (ROE) for electric utilities approved in cases decided during 2023 was 9.60%, and the ROE authorizations ranged from 8.63% to 11.45% for all electric equity return authorizations that include decisions for vertically integrated, distribution and limited-issued rider cases.

➤In the 30 jurisdictions where ROE was rendered, only four authorized an ROE above 10% — Alaska, California, North Carolina and Virginia and two authorized ROEs below 9% — Connecticut and Illinois.

➤Of the 63 ROE determinations in 2023, 36 were authorized in vertically integrated cases, 12 were authorized in distribution-only cases, and 15 were authorized in limited-issue rider proceedings.

The electric data set includes several limited-issue rider cases. Historically, the ROEs authorized in limited-issue rider cases were meaningfully higher than those approved in general rate cases, driven primarily by incentives allowed in Virginia for certain types of generation investment. These premiums have largely expired. Excluding rider cases, the average authorized ROE for electric cases was 9.66% in 2023 versus 9.58% in full year 2022.

The ROE determinations authorized by state public utility commissions in 2023 ranged from 8.63% to 11.45%, with an average of 9.60% and a median of 9.50%.

In recent years, the overall average ROE determinations for electric utilities have declined from 9.91% in 2014 to 9.60% in 2023 but are up from an all-time low of 9.38% in 2021.

Similarly, the averages for the vertically integrated and distribution cases have declined as well since 2014 but are trending higher since bottoming out in 2021.

There were 63 authorizations in 2023 in 30 jurisdictions. Of the 30 jurisdictions, only four authorized an ROE above 10% — Alaska, California, North Carolina and Virginia and two authorized ROEs below 9% — Connecticut and Illinois. Of the 63 ROE determinations in 2023, 36 were authorized in vertically integrated cases, 12 were authorized in distribution-only cases, and 15 were authorized in limited-issue rider proceedings.

In the 36 vertically integrated cases decided in 2023, authorized returns ranged from 9.25% to 11.45%, averaging 9.80%, with a median of 9.70%.

The highest ROE approved for an electric company in a vertically integrated case decided in the first half was 11.45%, authorized by the Regulatory Commission of Alaska(RCA) for Alaska Electric Light and Power Co. (AEL&P). In its order, the RCA stated that AEL&P failed to provide evidence showing that its size or bond rating poses an unusual risk to investors in regulated public electric utilities warranting an ROE risk premium and, therefore, failing to meet its burden of proof that increasing the previously approved 11.95% ROE is reasonable. The commission also noted that it does not find the “lack of additional regulatory adjustment mechanisms” — such as adjustment clauses, decoupling, normalization adjustments, the use of future test years, formula rates and multiyear rate plans — being available to AEL&P to increase investment risk. While the utility’s ROE expert had initially concluded that the cost-of-equity midpoint for a regulated electric utility is 10.45%, AEL&P had requested approval of a 13.45% ROE to reflect the higher risks associated with an equity investment in the utility. The commission, however, stated that “in view of the geographical isolation and possible greater than average climate change risks,” it found a 1% risk premium over AEL&P’s midpoint to be appropriate.

The second highest ROE in 2023 was 10.75% authorized by the California Public Utilities Commission for Edison International utility Southern California Edison Co. In California, ROE determinations for the state’s energy utilities occur outside of general rate cases in cost-of-capital proceedings. All major investor-owned utilities in California are required to file an application with the PUC every three years to review the authorized ROEs as part of a cost-of-capital proceeding. In the intervening years, automatic cost-of-capital adjustment mechanisms (CCMs) are in place, under which authorized equity returns are reviewed annually and, if changes in utility bond yields exceed 100 basis points, the authorized ROEs are adjusted by one-half of the difference. Since the increase in utility bond yields surpassed the threshold during the review period, the mechanism provided for an ROE adjustment ratio of 50% of the change between the 12-month index average and the benchmark, or 70 basis points, effective Jan. 1, 2024. The state’s other electric utilities were also authorized higher ROEs under the CCM.

The lowest authorized equity return for the vertically integrated rate cases, at 9.25%, was authorized by the Minnesota Public Utilities Commission for Xcel Energy Inc. subsidiary Northern States Power Co.– Minnesota (NSP-M) as part of a multiyear rate plan. In adopting a 9.25% ROE, the PUC stated that it was “unpersuaded by Xcel’s claims that a 9.25% return is insufficient to enable the Company to attract capital at reasonable rates, maintain its credit rating and financial integrity, and provide returns commensurate with those earned on other investments with equivalent risks.” The PUC found value in intervenor, Xcel Large Industrials “arguments that Xcel’s investors face lower levels of risk because of the regulatory tools used by the Company, which include multiyear rate plans and riders.”

In August 2023, NSP-M filed for rehearing, stating that the PUC’s decision “fails to provide Xcel Energy a return commensurate with the returns being earned by enterprises of comparable risk.” According to the company, “new and relevant information demonstrates the inadequate nature of a 9.25 percent allowed return on equity and overall rate of return, and that the company’s requested return on equity of 10.20 percent continues to be consistent with current market analysis.” NSP-M took issue with the commission’s determination that it may have “lower risk” than other companies, arguing that it bears significant business risk through the ownership and operation of its nuclear power plants and that its high level of capital expenditures as it leads the clean energy transition in Minnesota increases its business risk, particularly in an inflationary environment. In October 2023, the PUC denied the company’s request for reconsideration. NSP-M filed an appeal of the decision to the Minnesota Court of Appeals in November 2023.

The second lowest ROE was 9.30%, which was authorized for Public Service Co. of Colorado and Public Service Co. of Oklahoma.

For PSCO, the 9.30% ROE authorized by the Colorado Public Utilities Commission was equal to that adopted by the utility in its last rate case decided in 2022. PSCO is a subsidiary of Xcel Energy Inc.

For PSO, the Oklahoma Corporation Commission authorized the utility a 9.30% ROE instead of the 9.50% ROE stipulated by the parties to the case and approved a less-equity-rich capital structure with a lower common equity component than had been agreed to in the settlement. In adopting a 9.30% ROE, the commission said: “In consideration of the relatively limited financial risk of PSO shareholders, and considering an evaluation of similarly situated proxy companies — while a [9.30%] ROE is greater than PSO’s market-based cost of equity, it is supported by substantial evidence and gradually begins to move in the direction of a market-based cost of equity. Further, this reduction in ROE results in savings to ratepayers and is fair, just, reasonable and in the public interest.” PSO is a subsidiary of American Electric Power Co. Inc.

There were 12 ROE authorizations rendered in distribution-only cases during 2023. The authorized returns in the distribution cases ranged from 8.63% to 9.70% and averaged 9.24% in 2023, with a median of 9.30%.

The highest distribution electric ROE of 9.70% was authorized by the Public Utility Commission of Texas for Oncor Electric Delivery Co. LLC.

The PUC stated that a 9.70% ROE “is appropriate for Oncor” and that “electric utilities face increasing inflation and less favorable short- and long-term interest rates than in recent years, which saw steady decreases in utility returns on equity.” The PUC noted that “in establishing a reasonable return on invested capital the Commission has the authority to consider the efforts of the utility in conserving resources; the quality of service; the efficiency of operations; and the quality of management.”

The PUC stated that it “recognizes Oncor’s high performance throughout its service territory in minimizing the number and duration of outages, maintaining system frequency, responding to storm damage, and restoring power to customers” and also “recognizes, however, that Oncor could improve timing of, and reduce the delays in, its interconnection process.”

The second highest ROE for the distribution group was 9.60%, authorized for Exelon Corp. subsidiary Atlantic City Electric Co., following the adoption of a settlement by the New Jersey Board of Public Utilities. The 9.60% ROE was the same as that approved the company in its previous base rate case in 2021, and that was also resolved by a settlement.

The lowest distribution electric ROE was 8.63%, authorized by the Connecticut Public Utilities Regulatory Authority (PURA) for The United Illuminating Co. (UI).

The 8.63% ROE for UI reflects a 47-basis-point reduction ordered by PURA to account for various management and operational performance issues. Prior to the imposition of penalties, a 9.10% allowed ROE was authorized. While ROEs authorized in Connecticut have historically been below the prevailing nationwide industry average, both the allowed ROE and the one after the imposition of penalties are considerably below the averages approved and are among the lowest authorized returns for energy utilities nationwide. The PURA ordered an earnings-sharing mechanism to continue under which all earnings above the authorized ROE are to be shared equally with customers.

UI is a subsidiary of Avangrid Inc., and Iberdrola SA is the parent company of Avangrid.

The second lowest ROE, at 8.72%, was authorized by the Illinois Commerce Commission (ICC) for Ameren Corp. subsidiary Ameren Illinois Co. as part of a multiyear rate plan. The 8.72% ROE authorized for Ameren Illinois was calculated using traditional techniques for estimating ROE. The commission said it “recognizes the lower risk that [Ameren Illinois] bears under a [multiyear rate plan] compared to formula rates and to traditional ratemaking in terms of more risk that is transferred from the company to its customers.” In addition to the low authorized return, the ICC rejected the company’s infrastructure investment proposal, finding that the proposal did not comply with certain aspects of the state’s Climate and Equitable Jobs Act (CEJA) of 2021. As such, Ameren Illinois is not permitted to commence its planned investment program for 2024–2027 at this time. Ameren Illinois has sought rehearing of the ICC’s order.

The multiyear rate plan was submitted in accordance with the CEJA that allows Ameren Illinois and the state’s other electric investor-owned utility, Exelon Corp. subsidiary Commonwealth Edison Co., to be subject to multiyear rate plans effective in early 2024. Under the multiyear rate plan, the ICC is to set base rates that would apply during each of the four years of the rate plan beginning in 2024 and determine the allowed ROE to be applied to the company’s forecast average annual rate base. The ROE is to be subject to adjustment based on certain performance metrics during the term of the plan. The law calls for applying “symmetrical” performance-based ROE incentives and penalties ranging from 20 basis points to 60 basis points in aggregate. The revenue requirement for a given calendar year is to reflect the utility’s actual capital structure. A capital structure including a common equity component of up to 50% is to be deemed “prudent and reasonable,” while a higher equity ratio would need authorization from the commission.

In the 15 limited-issue rider rate proceedings, authorized returns, which were all awarded by the Virginia State Corporation Commission (SCC), have ranged from 9.20% to 10.35%, averaging 9.40% in 2023 with a median of 9.35%.

The highest ROE authorized for this group was 10.35%, authorized for Dominion Energy Inc. subsidiary Virginia Electric and Power Co.‘s (VEPCO’s) investment in the 1,472-MW natural gas-fired, combined-cycle Warren County Power Station, which achieved commercial operation in 2014. The rider for this investment was first implemented in 2012. In approving the rider, the SCC indicated that VEPCO’s investment in the facility would be accorded a 100-basis-point incentive ROE adder from construction through the first 10 years of the plant’s operation.

The lowest ROE for this group was 9.20%, which was authorized by the SCC for Appalachian Power Co. for the company’s investment in the Dresden generating plant. The ROE authorized is that approved in the company’s 2020 periodic earnings review proceeding.

For a chronological listing of the major energy rate case decisions issued during 2023 and historical summary data going back to 1990, see Regulatory Research Associates’ latest “Rate Case Decisions Quarterly Update.”

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA’s in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.